Four years after world leaders negotiated the Paris Climate Agreement, now signed by 195 countries around the world and ratified by 187, national policies and market signals are starting to reflect the urgency both of increasing finance for mitigation of and adaptation to the effects of climate change, and of making all financial flows consistent with a pathway toward low-carbon and climate-resilient development. However, much more ambition will be needed to avoid the most catastrophic effects of climate change, including a push at the national level for countries to meet and exceed their climate action plans.

The 2019 edition of Climate Policy Initiative’s Global Landscape of Climate Finance (the Landscape) again provides the most comprehensive overview of global climate-related primary investment. This year’s report includes six years of consecutive data, including the first major wave of investments following ratification of the Paris Agreement, in 2017 and 2018.

Annual tracked climate finance in 2017 and 2018 crossed the USD half-trillion mark for the first time. Annual flows rose to USD 579 billion, on average, over the two-year period of 2017/2018, representing a USD 116 billion (25%) increase from 2015/2016. The rise reflects steady increases in financing across nearly all types of investors.

Total global climate finance flows, 2013-2018

Increases are concentrated in low-carbon transport (by sector) and North America and East Asia (by region). Just under one quarter of the increase in climate finance tracked in 2017/2018 is due to the incorporation of new data sources into the Landscape, including EV charging infrastructure investments; private investment in sustainable infrastructure; and use of proceeds of bonds issued by the private sector and regional and municipal governments.

Climate finance flows reached a record high of USD 612 billion in 2017, driven particularly by renewable energy capacity additions in China, the U.S., and India, as well as increased public commitments to land use and energy efficiency. This was followed by an 11% drop in 2018 to USD 546 billion. Changes in lending patterns due to regulatory shifts in the East Asia & Pacific region, in addition to a global slowdown in economic growth and significant year-over-year decreases in renewables costs, resulted in reduced public low-carbon transport and private renewable energy investment in 2018.

While climate finance has reached record levels, action still falls far short of what is needed under a 1.5 ˚C scenario. Estimates of the investment required to achieve the low-carbon transition range from USD 1.6 trillion to USD 3.8 trillion annually between 2016 and 2050, for supply-side energy system investments alone (IPCC 2018), while the Global Commission on Adaptation (GCA 2019) estimates adaptation costs of USD 180 billion annually from 2020 to 2030.

There is a need for a tectonic shift beyond ‘climate finance as usual.’ Annual investment must increase many times over, and rapidly, to achieve globally agreed climate goals and initiate a truly systemic transition across global, regional, and national economies. In addition to scaling up climate finance, it is also necessary to drastically reduce new fossil fuel investments, which are at odds with the Paris Agreement. Investments that lock in high-carbon emission pathways and lead to potential stranded assets, such as fossil fuel power generation and supply infrastructure, must be phased out. Finance also needs to better factor in climate risks and avoid aggravating ecosystems’ vulnerability to climate change.

In this context, scarce public and other concessional financial resources must be used in a more transformative way. This will require unprecedented collaboration between governments, regulators, development banks, and private investors to align all financing with climate and sustainable development goals (SDGs), in order to identify the business models that can best enable private investment at scale, and to apply common frameworks to define climate-aligned and SDG-compatible investment.

PUBLIC FINANCE

Average annual public climate finance totaled USD 253 billion in 2017/2018, representing 44% of total commitments. Spending on transport again outpaced renewable energy to become the largest beneficiary of public finance, receiving USD 94 billion, or 37% of the public total. Large sums of public money were also dedicated to adaptation and resilience, energy efficiency, land use, and projects with cross-sectoral impacts.

Domestic, bilateral, and multilateral development finance institutions (DFIs) continue to account for the majority of public finance and increased their average commitments in 2017/2018, but economic developments in 2018 led some major players to reduce investment. National DFIs continued to be the largest providers of climate finance among DFIs, but unlike in 2015/2016, when their commitments almost doubled from 2013/2014, national DFI flows remained steady at an annual average of USD 132 billion in 2017/2018. A global slowdown in economic growth and a shift in domestic policies toward deleveraging and financial risk management, especially in East Asia & Pacific, are likely to have impacted national DFIs in 2018. At the same time, many bilateral and multilateral DFIs, individually and collectively, have recently made renewed commitments to significantly increase levels of financing in the short term and work toward making all development bank finance compatible with climate and SDG goals in the longer term (MDBs, 2018; IDFC, 2019).

Tracked climate finance provided by governments and their agencies doubled to USD 37 billion in 2017/2018, partly due to better availability of data on government activities. Expanded data coverage included electric vehicle (EV) charging infrastructure investments and bonds issued by regional and municipal governments. At the same time, increased government support for retail purchases of EVs, a category included in the 2015/2016 figures, also contributed to the rise.

PRIVATE FINANCE

Private finance, which reached USD 326 billion on average annually in 2017/2018, continues to account for the majority of climate finance, at around 56%. Of this quantity, 85% flowed to renewable energy, 14% to low-carbon transport, and under 1% to all other subsectors. This pattern partly reflects data limitations, but is also consistent with a preference for more commercially viable sustainable projects and industries among private investors.

Corporations continue to account for the majority of private investment, but commercial financial institutions play a more important role than ever, increasing financing by 51% from 2015/2016 to 2017/2018. Finance from institutional investors and smaller funds also increased more than fourfold from 2015/2016. While new data sources contributed a small portion of this growth, increased financing from actors who do not typically provide primary finance for infrastructure indicates a renewable energy market reaching greater maturity and projects perceived to be less risky. The proliferation of regulatory and industry initiatives to shift finance toward sustainable activities may also be starting to have an impact. Finally, households increased their climate-related consumption to USD 55 billion, a 32% increase from 2015/2016, likely signifying greater awareness and more widespread availability of sustainable alternatives in energy and transport.

INSTRUMENTS

Market-rate debt was the financial instrument used to channel the most climate finance in 2017/2018, averaging USD 316 billion annually. Seventy percent of this debt was provided at the project level, while the remaining 30% was balance sheet borrowing. An additional USD 64 billion in debt was issued as low-cost project debt, bringing the total debt issued for climate financing in 2017/2018 to an annual average of USD 380 billion, or 66% of all tracked finance, a similar share to the 2015/2016 figure. As expected, almost all low-cost project debt (93%) originated from public sources, as DFIs provided the bulk of concessional loans for climate-related projects. The second-largest instrument type as a percentage of tracked climate finance was equity, at 29%, averaging USD 169 billion annually. Seventy-four percent of this total was balance-sheet equity, while the other 26% was invested at the project level.

Grants accounted for an additional USD 29 billion per year in 2017/2018, or 5% of total climate finance. As in previous years, almost all grants were issued by the public sector, focusing on geographies and sectors underserved by commercial finance, with 78% of public grants directed to non-OECD regions, 35% of which flowed to the low-carbon transport sector and 24% to the agriculture, forestry, land use, and natural resource management sector.

USES AND SECTORS

The vast majority of tracked finance continues to flow toward activities for mitigation. Mitigation finance accounted for 93% of total flows in 2017/2018, or USD 537 billion annually on average. Adaptation finance made up another 5% of flows, showing no change from 2015/2016 as a percentage of tracked finance. However, finance with both mitigation and adaptation benefits rose to 2.1% of total flows in 2017/2018 compared to 1.2% in 2015/2016, suggesting a growing understanding of the integrated nature of the two categories.

Financing for low-carbon transport is increasing rapidly. Average annual finance to transport projects rose by 54% from its 2015/2016 level to USD 141 billion in 2017 and 2018. This was primarily led by increased investment in rail and transit projects by corporate and public actors, and increased purchases of EVs by households. In addition, the inclusion of investment in EV charging infrastructure in the Landscape for the first time accounted for an additional USD 3 billion per year in the sector compared to 2015/2016.

Renewable energy remains the primary destination sector for global climate finance tracked in the 2017/2018 Landscape, representing USD 337 billion annually, or 58% of global climate finance. Levelized costs of electricity generated by wind and solar have reached historic lows, and growing investment has increased global cumulative installed capacity to well over 500 GW for both technologies (IEA PVPS, 2019; GWEC, 2019). Data coverage is much more comprehensive for renewable energy investments than for other areas, meaning the renewables sector makes up a larger proportion of overall tracked climate finance than it would if more comprehensive data were available in other sectors.

Adaptation finance rose significantly from its previous level in 2015/2016, with annual adaptation finance reaching USD 30 billion on average in 2017/2018. This year we also find a more balanced allocation of funds across adaptation sectors. While water projects remain the largest share of adaptation finance, spending on other sectors, including land use and disaster risk mitigation, also increased, though the latter may also be linked to heightened severity and frequency of extreme weather events.

Tracked adaption finance represents only a partial estimate, as definitional challenges, accounting issues, confidentiality restrictions, and an absence of universally accepted impact metrics results in limited data availability, particularly with regard to the private sector. However, efforts are underway to improve methodologies and fill remaining gaps, as evidenced by the common principles developed by MDBs, among others. Nonetheless, the overall share of finance flowing toward adaptation and resilience falls far short of international needs and targets as specified in the Paris Agreement.

GEOGRAPHIES

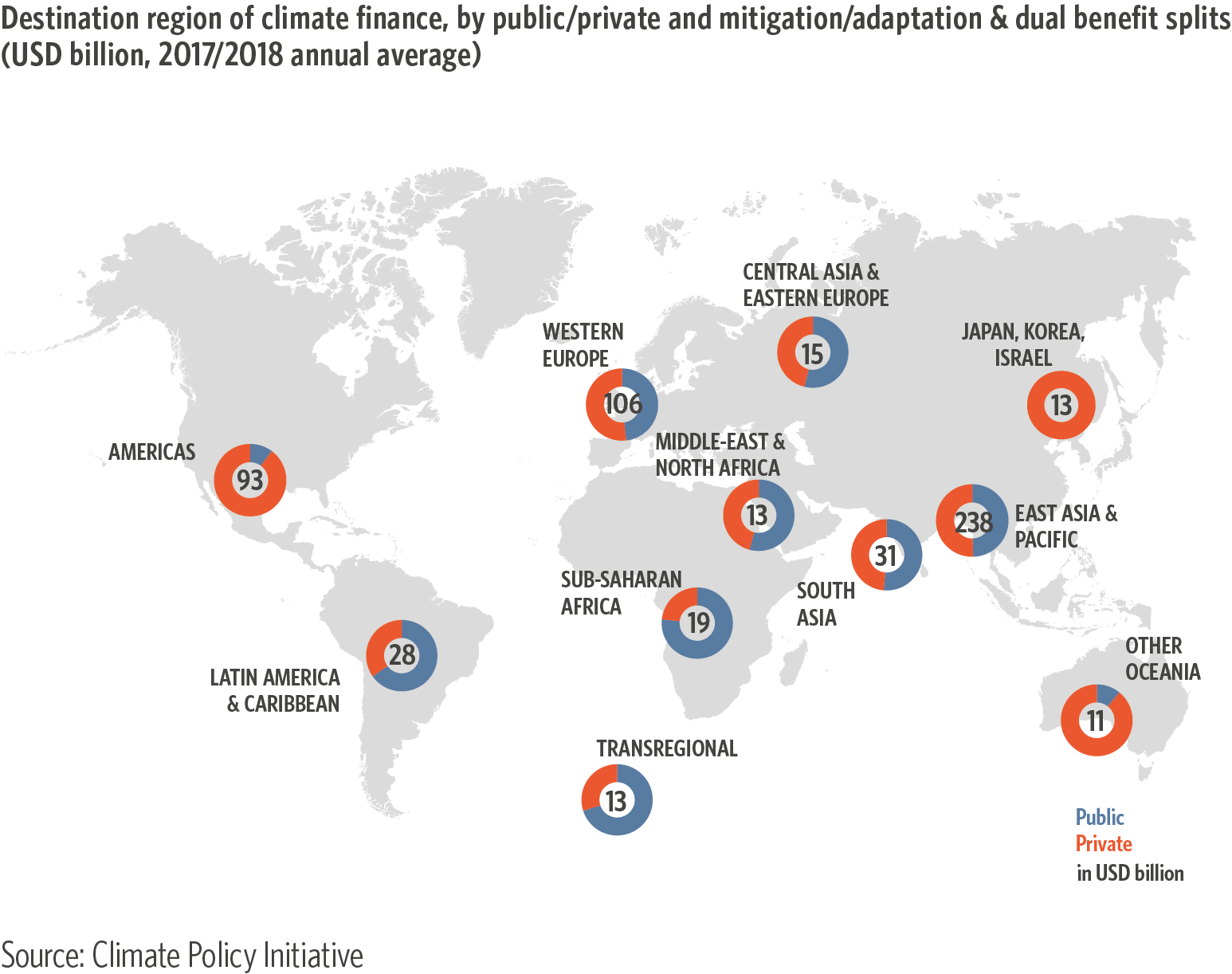

Finance for projects in non-OECD countries reached USD 356 billion, a major increase from USD 270 billion in 2015/2016 and, at 61% global climate finance, a larger share of total flows than in 2015/2016 (58%). East Asia & Pacific remained the largest regional provider of and destination for climate finance, rising to USD 238 billion on average per year in 2017/2018 from USD 180 billion in 2015/2016. Almost all regions saw an increase in total climate finance received, other than Western Europe, Japan, Korea, and Israel.

Most climate finance – 76% of the tracked total – is still invested in the same country in which it is sourced. As in previous Landscapes, this reveals a strong “domestic preference” among investors where home-country risks are well-understood, indicating the importance of national-level factors which policy and enabling frameworks can help to address.

RECOMMENDATIONS

Based on the trends identified in this report, we identify several opportunities to scale up and speed up the growth of global climate finance.

Governments should continue to raise the level of ambition in national climate plans and allocate resources to enable implementation of these plans. In response to the vast financing gap, many countries are renewing pledges to decarbonize their economies. Furthermore, governments have the unique opportunity to drive ambition and increase climate finance by explicitly adjusting the mandates of national institutions and of development banks, including explicit references to the Paris Agreement and the SDGs. Regulators also have a key role in supporting this development, by incorporating climate concerns into regulatory frameworks. Public financial institutions must focus on the effectiveness and impact of climate investments in order to maximize value per dollar and ensure that public finance is used as a lever for transformative change.

Public and private actors must coordinate to rapidly scale up finance in sectors beyond renewable energy generation. In 2017/2018, renewable generation investments accounted for 58% of all tracked climate finance, largely due to the existence of well-developed market paradigms and business models in the sector. To achieve transition to a low-carbon, climate-resilient economy, all financial actors will need to increase their investment in other sectors, especially energy efficiency, adaptation, and land use. The public sector and other actors, such as philanthropic foundations, have an important role in facilitating private finance, through both regulation and blended finance (CPI, 2018a). In addition, a strong commitment to deep decarbonization should emphasize research and development of new technologies, rather than targeting only low-cost marginal abatement opportunities, in order to enable technological pathways to net zero (CPI & Climateworks, 2018). Tracking progress toward this goal will require better, deeper data on climate-related R&D spending.

All financial actors should seek full alignment with the Paris Agreement across all of their operations, including, but not limited to, their loan portfolios. For public institutions, this will mean strategic collaboration with governments, refreshed investment pipelines, and reassessment of risk management, asset valuation, and capital allocation practices. Meanwhile, private actors must implement initiatives to measure, disclose, manage, and mitigate climate risks, and move capital away from high-carbon activities toward sustainable sectors. Any new finance for fossil fuels increases the risk of falling further behind the goals established by the Paris Agreement. Furthermore, all actors must contribute to closing the adaptation finance gap, requiring urgent scaling up of investment in adaptation projects and long-term climate resilience in all infrastructure. Opportunities to direct investment toward adaptation and long-term climate resilience already exist in areas like water security and resilience for urban populations living in poverty (GCA, 2019).

Capital markets and banking must shift toward green finance. While the Landscape and other climate finance tracking efforts focus on primary infrastructure investment, overall financial markets are another important component of the climate finance ecosystem. Banks and other lenders greatly influence climate outcomes, as illustrated by their lending tracked in the Landscape and in recent findings on lending for fossil fuel investment and should therefore be considered in future assessments of progress in transitioning to a greener economy. In addition, future tracking efforts will need to map the integration of climate metrics into business models, strategies, and policies, as informed by initiatives to measure, disclose, manage and mitigate climate risks, such as the Taskforce for Climate-Related Financial Disclosures. More widespread disclosures will enable analysis of the climate impact of financial markets, opening the way to climate-aligned capital mobilization. Meanwhile, developing project- and asset-level investment tracking and climate risk assessment tools can aid in creating methodologies to map climate-aligned finance at scale.

Public institutions in particular must make every dollar count and ensure quality as well as quantity of flows. The lack of appropriate resources and methods to evaluate the effectiveness of climate investments is a pressing concern. Data on the substantive benefits of climate-oriented investments will need to be sourced from a wide range of actors and communities, requiring a collaborative approach. Better information can guide public finance towards more transformative uses, aimed at unlocking other pools of capital instead of crowding out private investors. Mobilizing private actors demands a deep understanding of different countries’ low-carbon development pathways, especially in coordinating investment flows and needs in developing countries to ensure priority sectors receive the finance required.

Finally, the climate finance tracking community will need to further anticipate, adapt to, and promote these changes to facilitate a rapid transition. Achieving alignment with the Paris Agreement will require new definitions, frameworks, and methodologies to understand which financial flows are consistent with the Agreement’s goals, and which are not. CPI’s newly formed Climate-aligned Finance Tracking Group is one forum for making progress in this area – alongside initiatives such as the OECD Research Collaborative, the Joint MDB Climate Finance Group, and the Climate Action in Financial Institutions Initiative – helping to convene stakeholders in the tracking community to pool resources and link areas of expertise.